The rise of Treatonomics: small luxuries in hard times

We’re living in the age of Treatonomics - the boom of small luxuries when bigger goals feel out of reach. From lipsticks and collectible toys to concerts with sky-high ticket prices, people are choosing treats that feel possible in uncertain times. Traditional milestones like buying a home or planning a wedding are being replaced by smaller “inch-stones”: a latte after a bad day, skincare as self-care, or even a birthday party for a pet.

It’s a modern twist on the old Lipstick Effect, but far more intense. Today, treating ranges from a $5 pick-me-up to a $500 escape, each purchase carrying emotional weight beyond its price tag. Our survey of nearly 2,000 people shows just how deeply this culture runs.

Key results

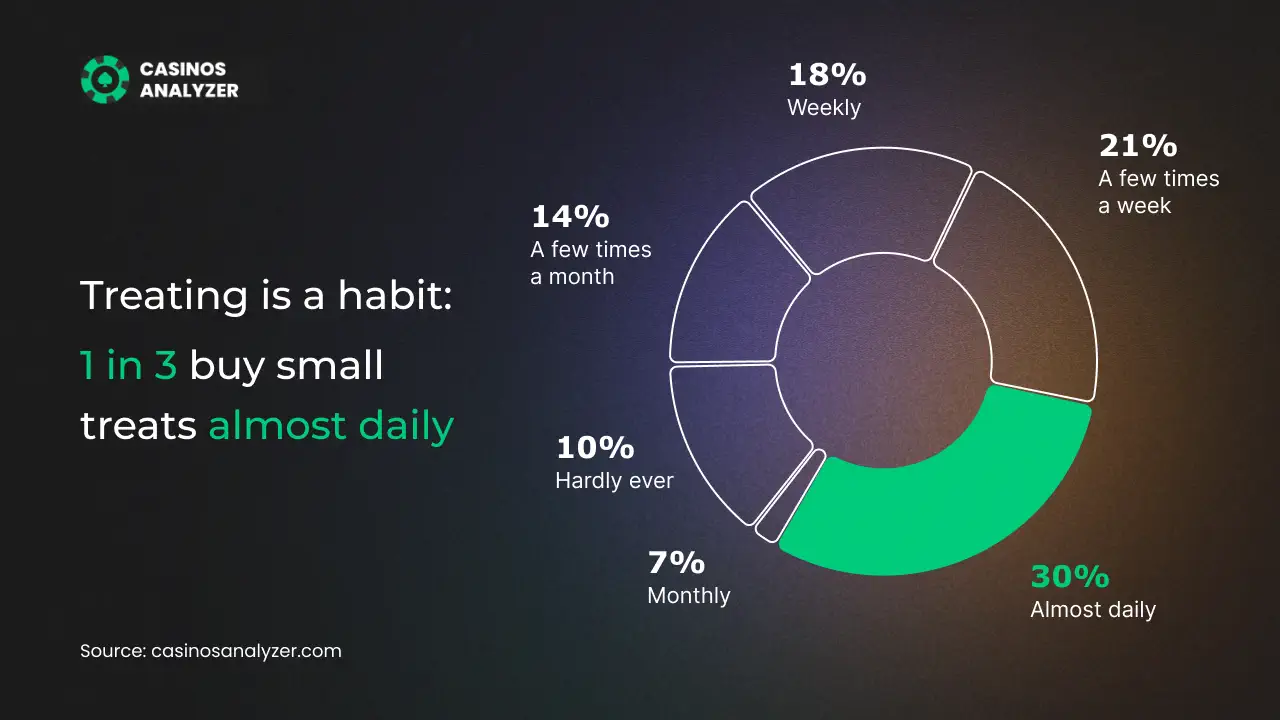

- 1 in 3 buy small treats almost daily; only 10% “hardly ever.”

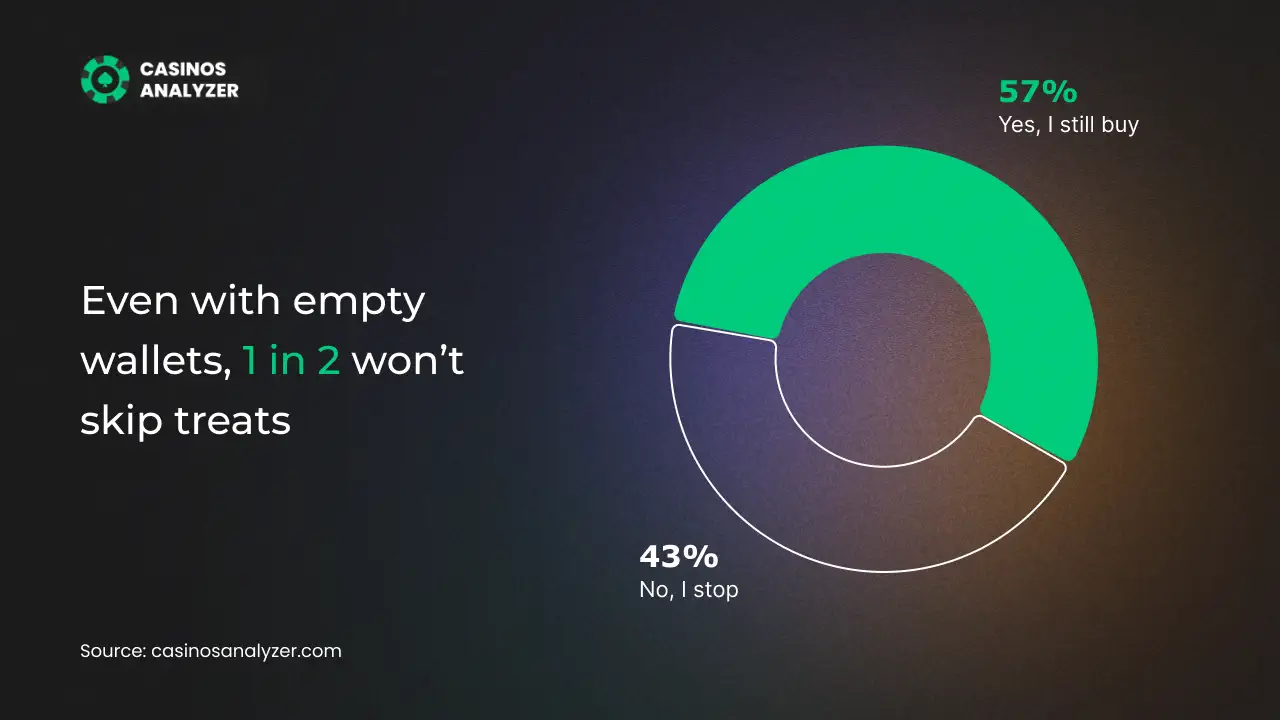

- Over half (57%) keep buying treats even when broke.

- 63% say treats cheer them up, but 1 in 10 feel worse after.

- 73% believe small luxuries are modern addictions.

- To afford indulgences, 44% borrowed money; 23% even delayed rent.

Habits: small luxuries, big routines

1 in 3 (30%) say they buy small treats almost daily, which turns indulgence into routine. Another large slice does it multiple times a week, pushing treats out of the “special occasion” box and into everyday life. Only 10% claim they “hardly ever” treat themselves – the true outliers now. If you feel like everyone around you is on a first-name basis with their barista, you’re not imagining it.

Can we afford the habit?

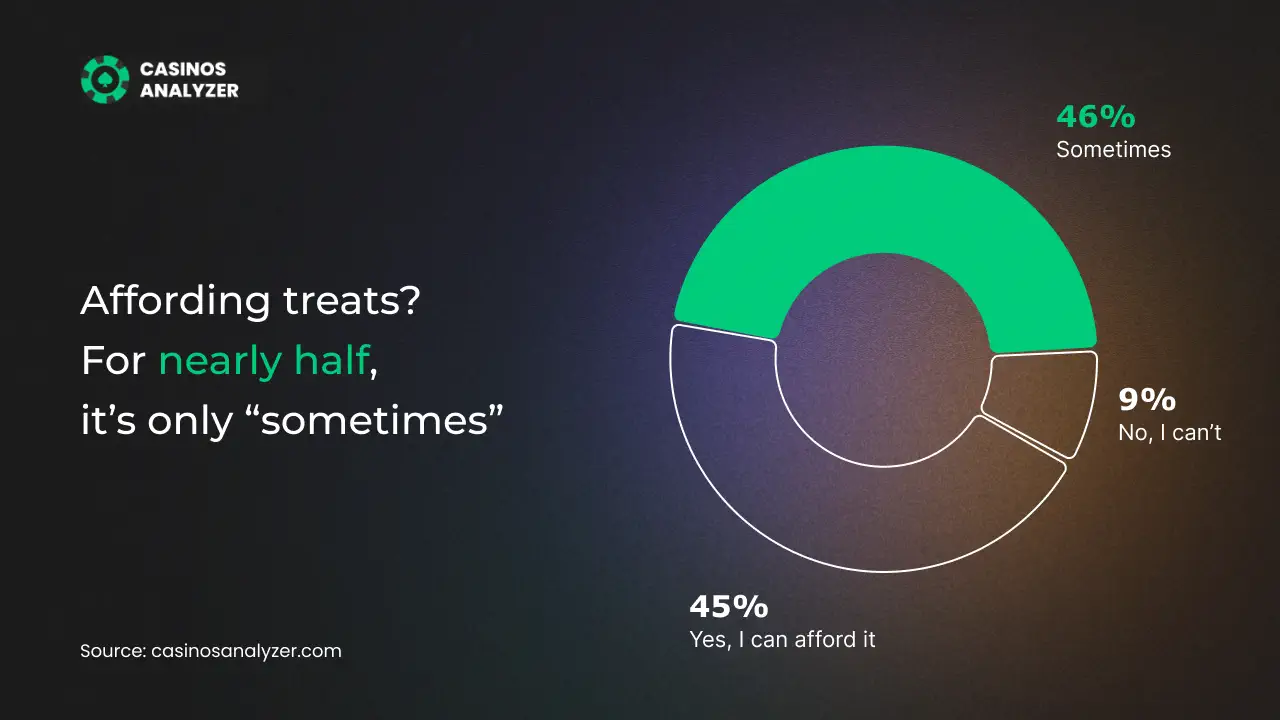

Affordability sits on a knife-edge. 45% say they can afford their treats, yet an equal 46% hedge with “sometimes,” which is really a feeling as much as a number. And 9% admit they can’t – but still, many of them buy anyway. That tension between comfort and cost is the emotional surcharge baked into every small luxury.

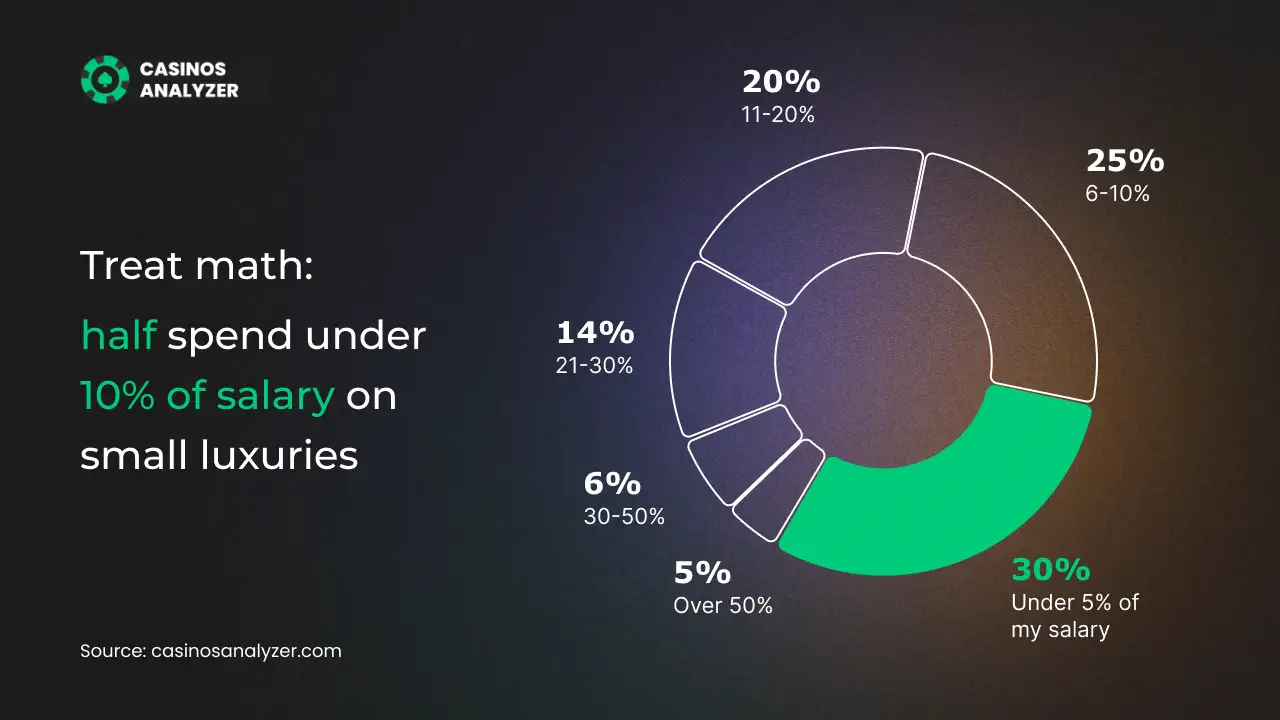

For most, spending stays modest: 30% keep it under 5% of their salary. But the outliers are impossible to ignore: 6% spend 30–50%, and another 5% pour over half of their income into small luxuries. That’s not a splurge, it’s a second rent check funneled into coffees, candles, and quick highs. It shows two extremes of Treatonomics: for many, treats are harmless boosts, but for some, they swallow the biggest slice of the paycheck.

Coping under pressure

The habit doesn’t stop when the money does. 57% keep buying treats even when they’re broke, and the rest (43%) are the minority who actually hit pause. That’s Treatonomics in a sentence: the ritual survives the budget. When resources shrink, people protect the tiny things that make life feel normal.

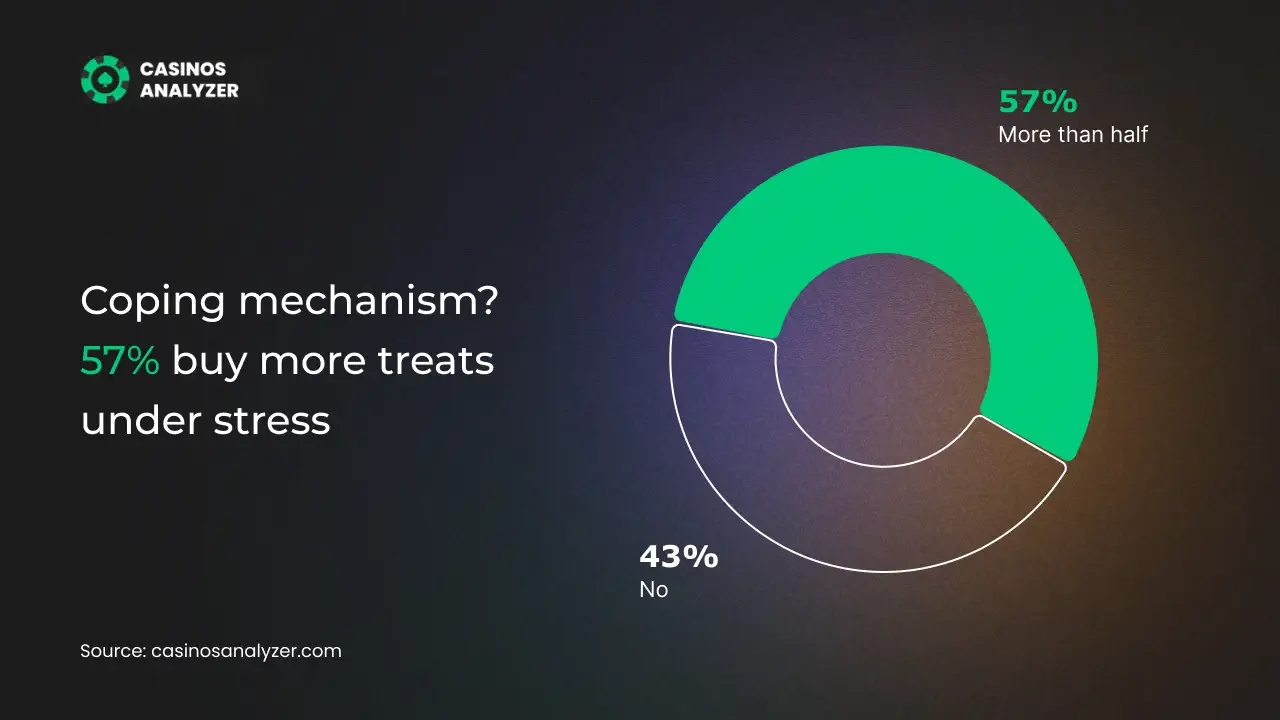

Stress turns the dial up. 57% buy more when stressed, while 43% say pressure doesn’t change their behavior. For most, treats act like a quick mood stabilizer – not a solution, a moment. The purchase is small; the relief feels bigger.

Emotional impact and dependence

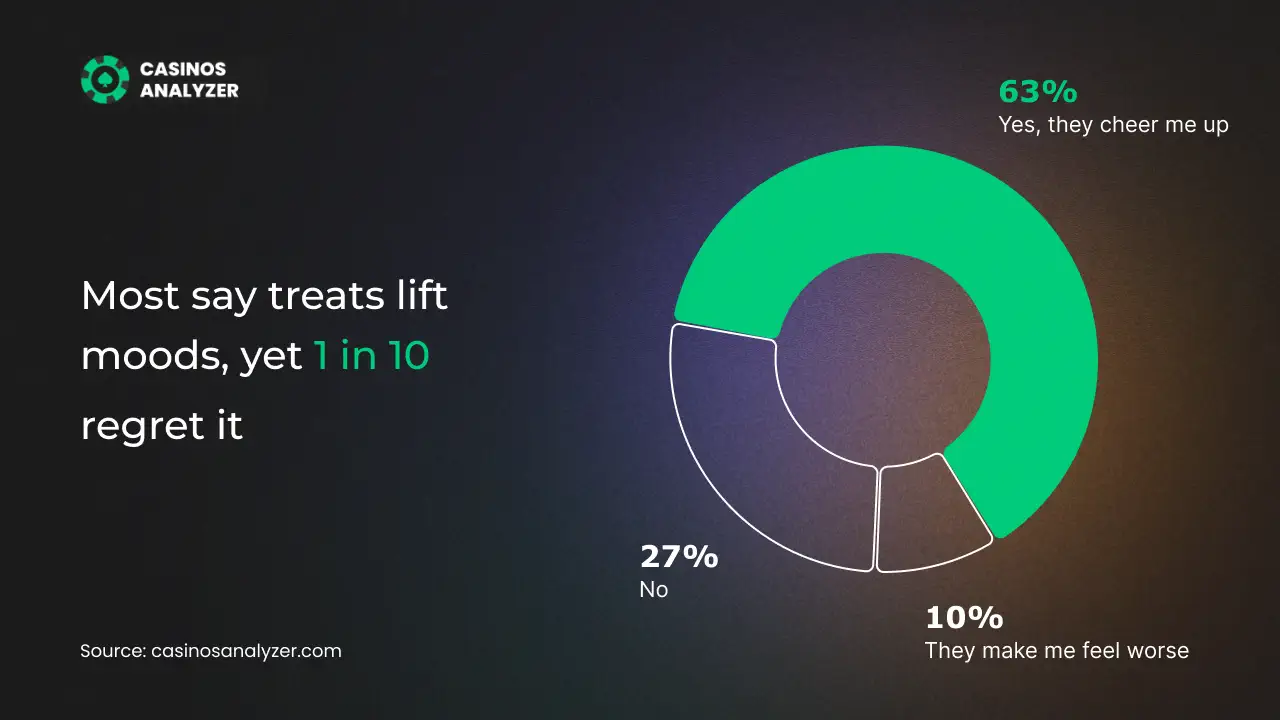

For the majority, the boost is real: 63% say treats cheer them up. But the glow isn’t universal – 27% don’t feel much difference. And for 1 in 10 (10%), it backfires, leaving them feeling worse after the high fades. That’s the paradox of a pick-me-up that sometimes picks a fight.

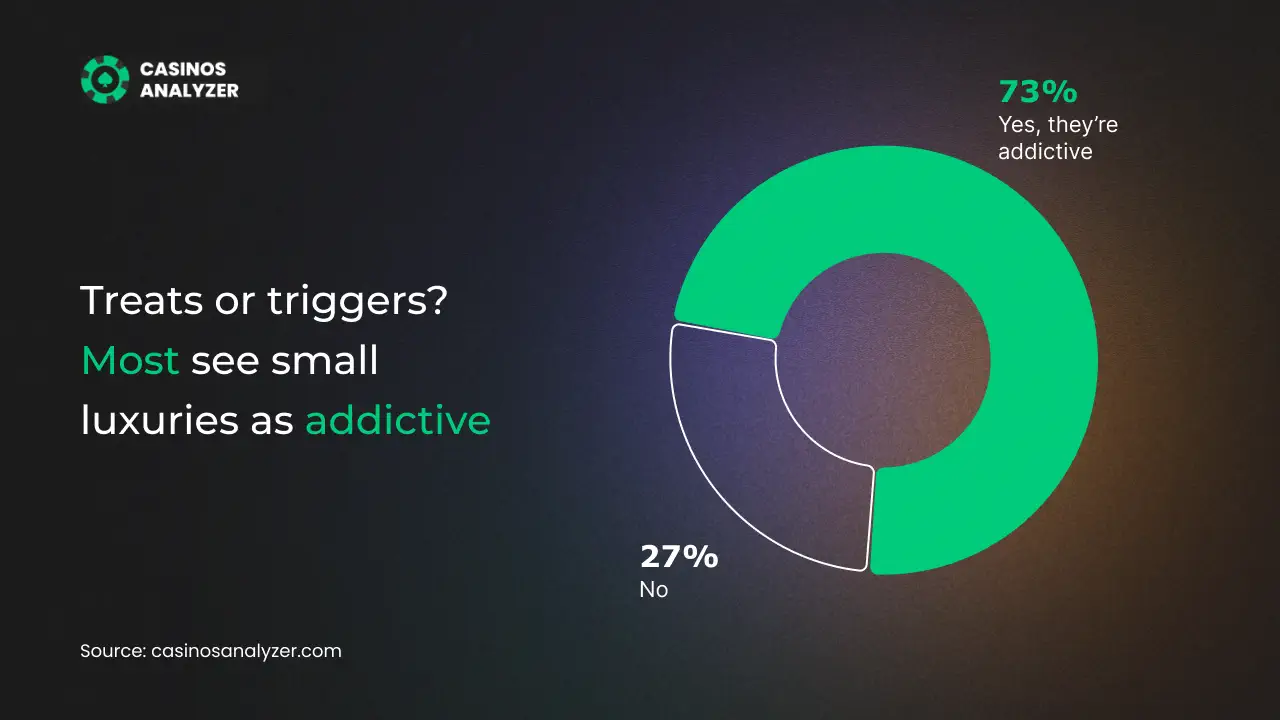

The public verdict is blunt. 73% believe small luxuries are a modern addiction, easy to start and hard to dial back. Only 27% reject that framing. If most people describe it like a compulsion, brands and policymakers should probably listen.

Trade-offs and non-negotiables

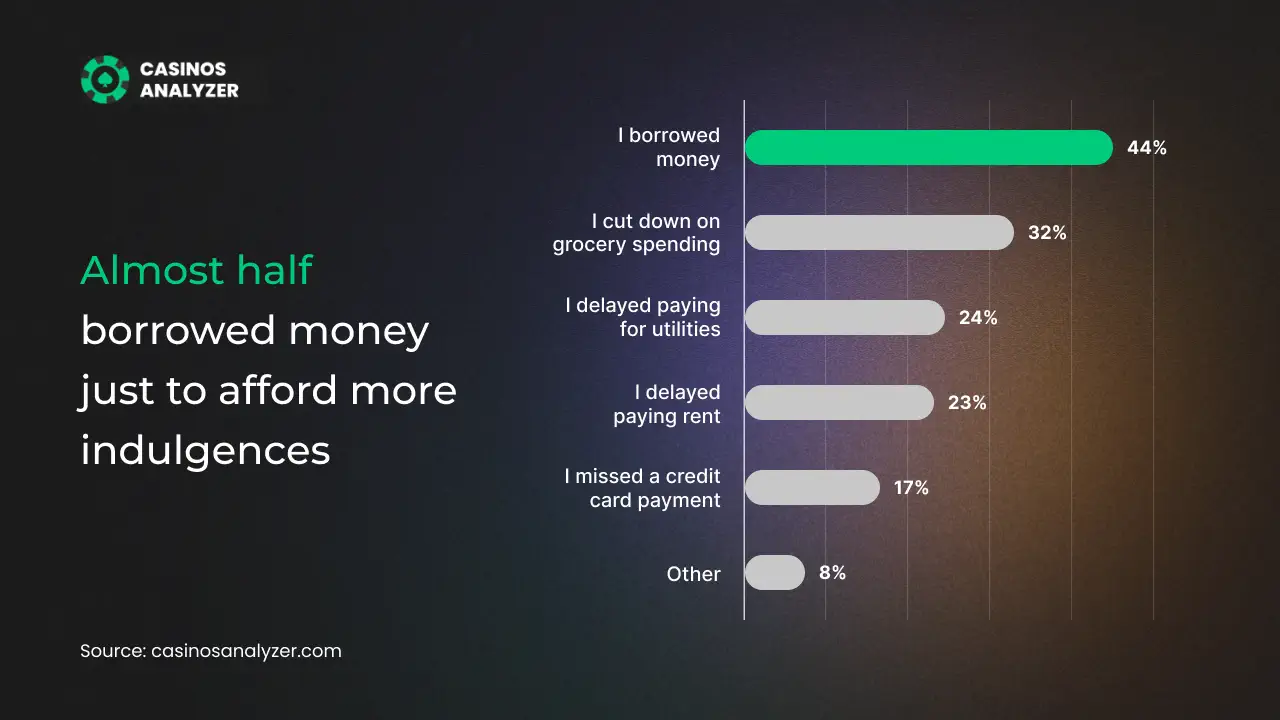

To keep their treats, people are willing to stretch their budgets in risky ways. 44% admit they’ve actually borrowed money just to afford indulgences, while another 32% cut back on groceries to make room. Beyond that, some even let essential bills slide, choosing comfort over obligations. What looks like a harmless pick-me-up carries hidden weight – proof that in Treatonomics, small luxuries can drive surprisingly big sacrifices.

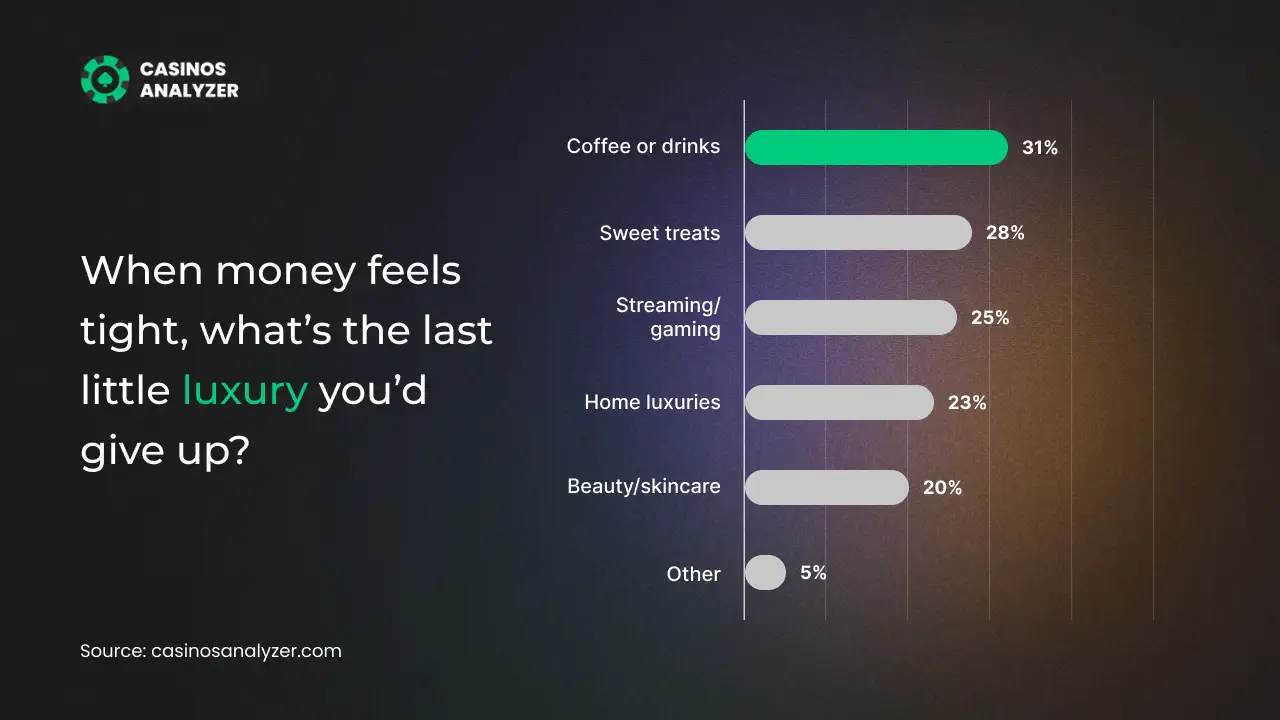

When push comes to shove, coffee/drinks are the hill people die on: 31% would give them up last. Sweet treats (28%) and streaming/gaming (25%) form the next line of defense. Beauty and home comforts follow later, but not without a fight. If caffeine feels non-negotiable, you’re in the majority.

How we frame it

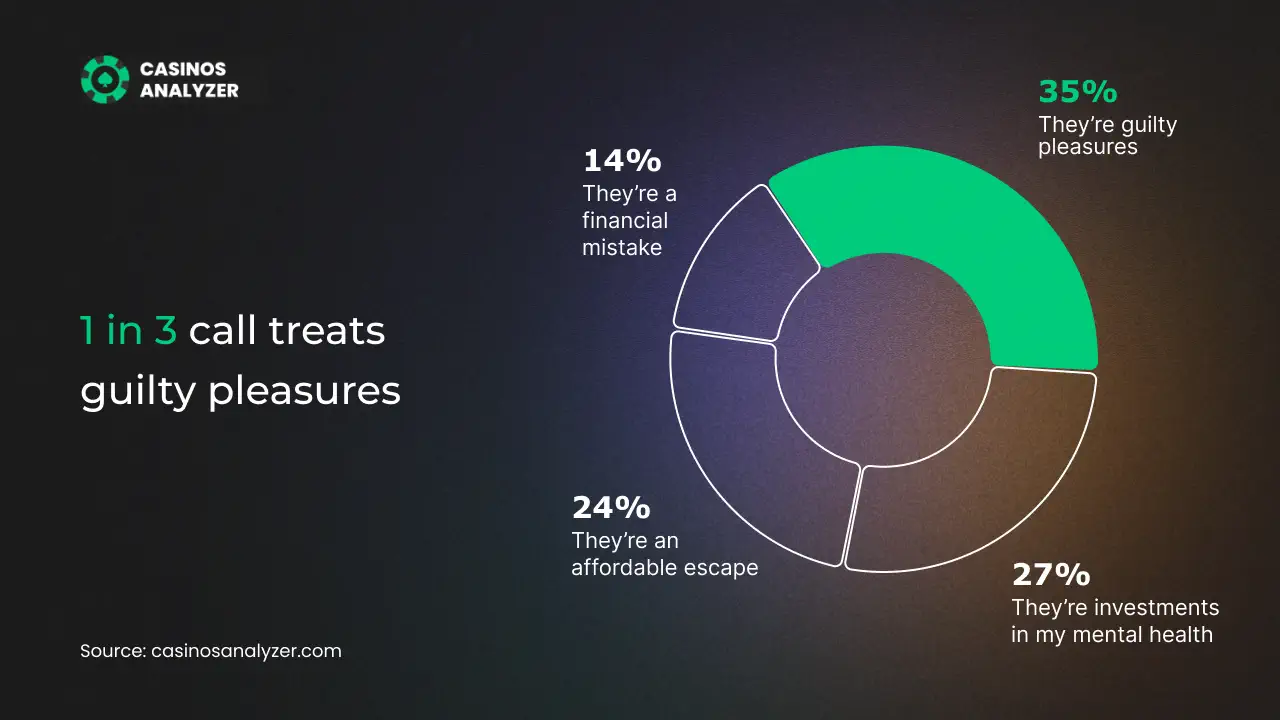

This is where the story splits. 35% call small luxuries guilty pleasures; 27% defend them as a mental health investment. Add 24% who see an affordable escape, and more than half frame treats as emotional maintenance, not waste. The same purchase can be comfort, coping, or a mistake – it depends on who’s holding the cup.

Methodology

To create this study, researchers from Casinos Analyzer surveyed 2,000 participants of all genders, aged 21 and over.